Central bank officials around the world have said taming inflation is their top priority, but rising prices have turned out to be stickier than originally expected.

The U.S. economy saw a pickup in inflation that began in 2021 amid pandemic-induced supply chain issues. But the current inflation story seems to be more about services than demand constraints.

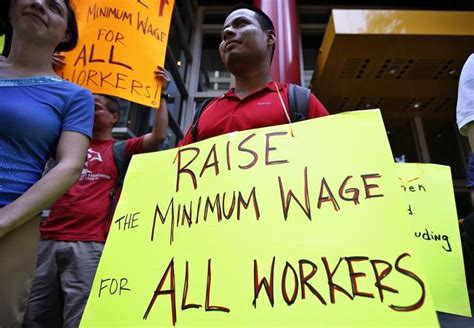

A worker shortage contributed to pushing wages and prices higher. Some workers have seen big pay increases since the second half of 2020. This led to record job openings and high turnover as people job hopped for more money and the unemployment rate declined sharply.

“Typically in inflationary periods, wages don’t keep up, and it’s the price of goods that are going up more than the cost of labor,” said Laura Veldkamp, Cooperman professor of finance and economics at Columbia Business School. “But this is an unusual episode where it seems like right now the main driver of inflation is actually labor costs, and what that means actually is that workers are gaining.”

But there are signs that wage growth is cooling, especially as layoffs have skyrocketed nearly fivefold in 2023 across some industries.

″[Employers] may increase their base salaries to say, ‘please stay,’” Lori Wisper, managing director at Willis Towers Watson, told CNBC. “The only way to correct for overpaying on base salary is reductions in force… And part of that reduction is layoffs.”

A common concern during periods of inflation is a so-called wage-price spiral. This is when workers expect their wages to rise to compensate for inflation, which in turn can push prices even higher. While central banks around the world are still cautioning about this continuing, experts seem more optimistic that the wage-induced inflation loop won’t be as big of a threat as first expected.

“Everything is slowing,” Denise Chisholm, director of quantitative market strategy at Fidelity Investments, told CNBC. “The CPI, or the generalized level of price, is decelerating quicker than wage growth. And that’s right now a positive.”

Who didn’t see this coming? Raise wages and companies have to increase costs of products. Either that or lay off workers or move to robotics. That is if they don’t want to increase prices that the customer pays. If they do that the pay increases are voided. As everyone pays the increases in price. The only ones benefitting is the government in the form of increased taxes. Income tax, sales tax, so on and so on.