By Zachary Halaschak

The most expensive item over the first half-decade of President Joe Biden’s climate and social spending legislation is a tax cut for the wealthy.

The Democratic Build Back Better Act, which passed the House on Friday morning, raises the current $10,000 cap on federal tax deductions for state and local taxes to $80,000, a move that leads to a significant tax cut for high earners in states with high taxes.

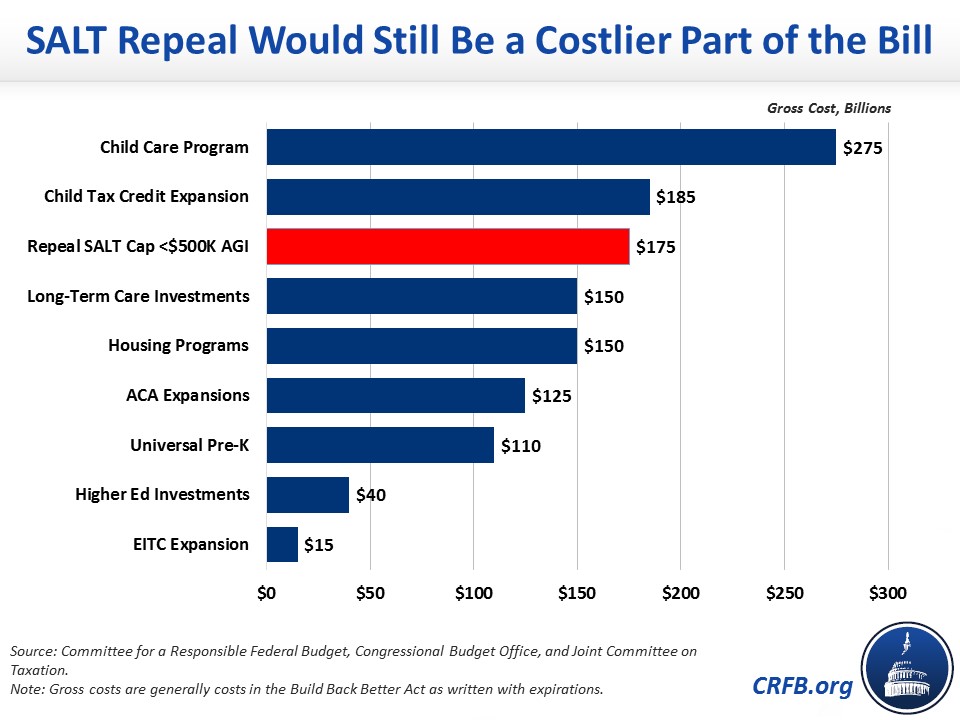

The provision dwarfs many of the other priorities in the legislation and was included under pressure from a vocal contingent of Democrats from high-tax blue states.

The nonpartisan Committee for a Responsible Federal Budget said that increasing the SALT cap to $80,000 through 2025 would end up costing the federal government $275 billion in revenue — an amount that is $5 billion more than the next costliest provision in the Build Back Better Act.

The Joint Committee on Taxation estimated Friday that the SALT cap change in the bill that the House passed would cost about $230 billion over the first five years. Over the next decade as a whole, the change is actually forecast to generate more than $14 billion after the cap is returned to the $10,000 level in 2027. The effects of major legislation are often analyzed on a 10-year basis. However, the increased SALT cap could be made permanent, as proponents hope, or it could be otherwise changed.

Thanks to the enlarged SALT cap, the Democratic bill would provide tax cuts to most high-income earners despite other significant tax hikes in the bill aimed at the wealthy. In its first year, 70% of millionaires would get tax breaks, according to the JCT’s analysis released Friday, and about half of millionaires would get tax cuts in the last year before the cap came back down.

While the SALT cap provision is the most expensive over the five-year time frame, other provisions are more expensive over a one-year budget window or over the course of a decade, a reflection of Democratic efforts to lower the overall cost of the legislation on paper.

For example, the extension of the boosted child tax credit will cost the Treasury $100 billion for just one year, according to the JCT, more than the SALT cap provision. But the expanded child tax credit is only being extended for one year, meaning that the five-year cost is lower than that of the SALT cap increase.

And over the course of the decade, the Democratic changes to the SALT cap actually raise taxes — on paper. That’s because the current $10,000 cap, which was introduced as part of the 2017 Republican tax cuts, is expected to expire in 2026, but the Democratic legislation would make the $10,000 cap permanent after 2027, meaning that it would raise revenues in the years 2027 through 2031.

“If you look at the entire 10-year window, then the SALT deduction actually doesn’t lose revenue at all. It actually raises revenue because it’s kind of self-financing in that it raises revenue in the last five years, although cutting taxes in the first five years,” said Kyle Pomerleau, a senior fellow at the American Enterprise Institute.

Pomerleau said that he thinks the provision will probably be changed in the Senate to appease centrist Democrats such as Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona.

One possibility is that the change will limit the benefit of raising the cap so that those making more than $500,000 (or another high amount) don’t get any of the benefits.

Even with a change such as limiting the provision to those making under $500,000, it would continue to cost a lot of revenue upfront and be regressive, said Pomerleau.

The inclusion of the SALT cap hike was championed by the so-called “SALT caucus.” Rep. Tom Suozzi of New York was one of the leaders of the charge and has consistently parroted the phrase “no SALT, no deal” in an apparent threat that he and others would not vote for any reconciliation legislation that did not include changes to the SALT cap.

Democrats have a wire-thin majority in the House and an evenly divided Senate, meaning that party outliers such as Suozzi and Manchin have outsize influence about what is in the bill, since Democrats can’t afford to lose their votes.

Read More From The PatriotAmerican

The Congressional Budget Office released its final projections of how much the behemoth spending bill would cost on Thursday night. The CBO found that Biden’s plan would increase federal deficits by $160 billion over the next decade.

The current plan has been panned by Republicans for having spending provisions that end early and would add to the deficit greatly if they were made permanent, as Democrats intend.

While the CBO didn’t score the plan with the extended provisions, the Wharton School at the University of Pennsylvania released a report that pegged the final cost as much higher, $4.6 trillion over 10 years, with the extensions included.