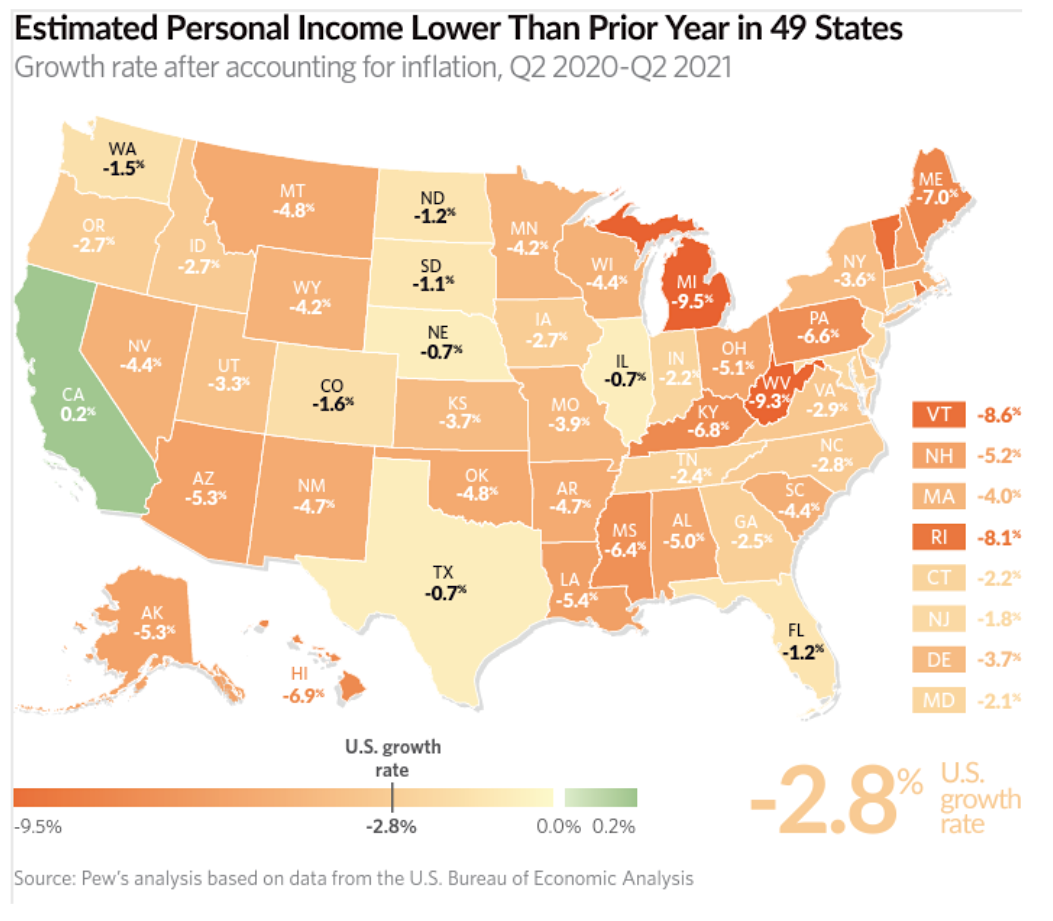

And now for something completely unexpected. Since the pandemic hit in the second quarter of 2020, the only state whose income has risen above inflation has been California, at 0.2 percent. That’s according to a recent study from Pew Research.

All other states saw personal income shrink. The worst was Michigan at -9.5 percent and West Virginia at -9.3 percent. Michigan was hit by massive pandemic-related disruptions to the auto industry. West Virginia’s dominant coal industry is under attack.

California’s Western economic rivals also fared poorly, with Arizona at -5.3 percent and Nevada at -4.4 percent. Our Southeastern low-tax rivals scored somewhat better, although still in negative territory, with Texas at -0.7 percent and Florida at -1.2 percent.

The national average was -2.8 percent. Here’s a map:

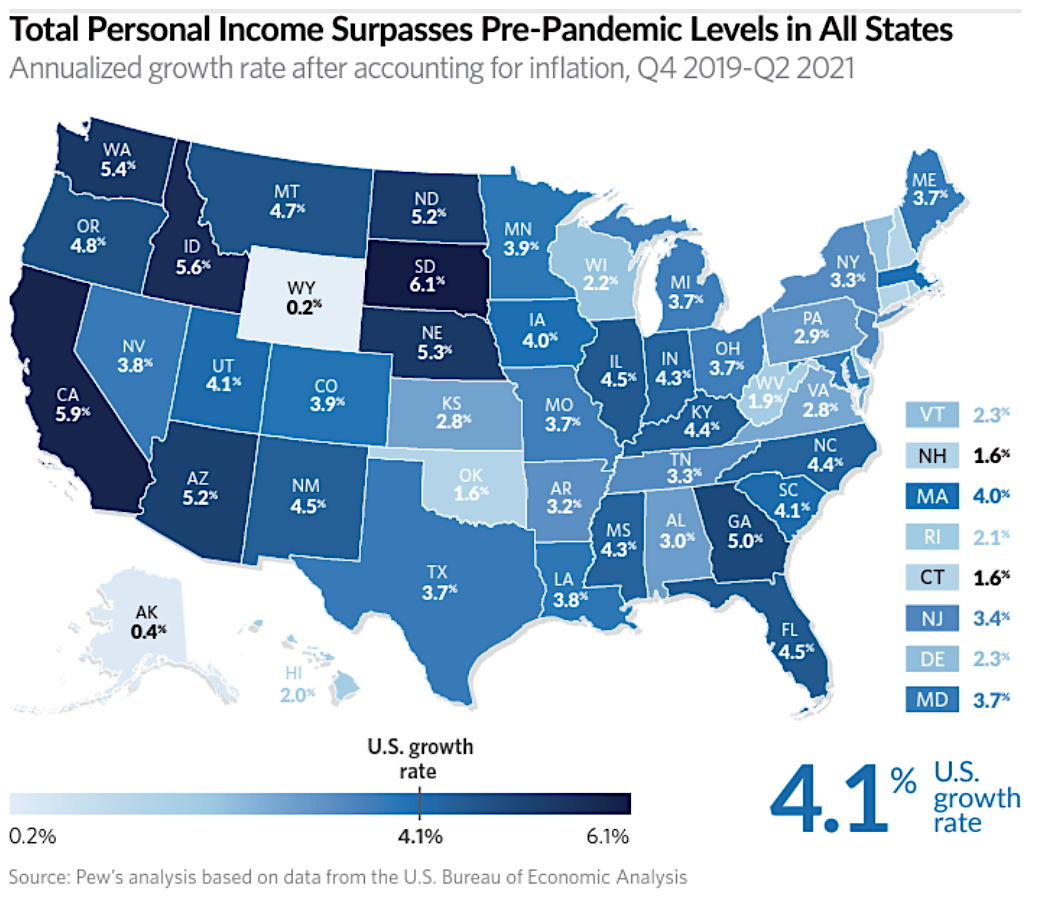

Inflation has become a national worry, with gasoline prices soaring above $5 a gallon at some California locations. When inflation is not included, California comes in second in personal income growth, at 5.9 percent, after South Dakota’s 6.1 percent.

Again looking at California’s rivals, Arizona was up 5.2 percent and Nevada 3.8 percent. Texas was up 3.7 percent and Florida was up 4.5 percent. No state was in negative territory. The national rate was 4.1 percent. Here’s a map:

Government Assistance

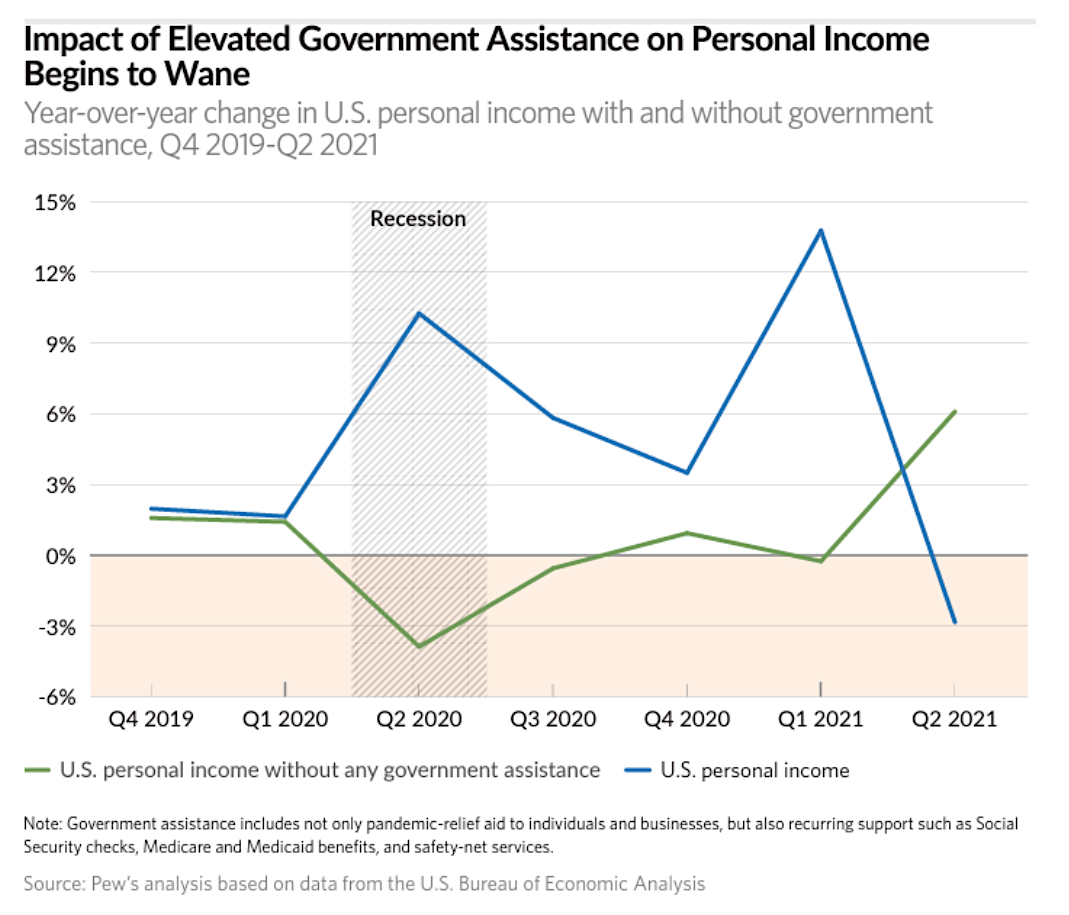

Much of the growth in every state was from the pandemic rescue packages, which now are ending. In March 2020, President Trump signed into law the $2.2 trillion CARES Act. And in March 2021, President Biden signed the $1.9 trillion American Rescue Plan. The $1.2 trillion Bipartisan Infrastructure Deal President Biden just signed will cost $1.2 trillion, although something like it has been in the works since before COVID-19 hit.

President Biden also has proposed a $1.75 trillion Build Back Better plan, although it’s questionable how much of it can be passed in Congress. A new and more detailed estimate of the actual cost will be released by the Congressional Budget Office on Nov. 19.

Of course, a good question is how all that borrowed money will be paid back. It could mean lower economic growth in the future as the bill is paid and taxes are raised, or federal spending is curtailed down the road.

Here’s PEW’s chart of the effects of the stimulus programs so far:

Why the Strong California Recovery?

The PEW data coincides with the massive additional income California’s state government has taken this past year. Gov. Gavin Newsom claimed the surplus was $76 as he campaigned against recalled. But the Legislative Analyst’s Office pegged it at a still impressive $38 billion. Yet one must always remember California’s unfunded liabilities have risen above $1 trillion. These largely include the unfunded pensions and retiree medical care of government employees past and future.

The quasi-surpluses are the result of the foolhardy “pension spiking” of two decades ago. That occurred during a similar period when Silicon Valley’s fortunes were soaring during the dot-com boom. Stockholders were dumping taxes from their profits into the state treasury. Then the dot-com bust hit 2000-02, collapsing state surpluses into $40 billion yearly deficits.

This time during the pandemic, as people stayed home, watched Netflix and ordered from Grubhub, Silicon Valley companies’ stocks again soared. Some examples since March 1, 2020 to the close of business on November 16, 2021:

- Apple Inc.: Up 138 percent, to a market capitalization of $2.48 trillion;

- Alphabet Inc./Google: Up 156 percent, to $1.97 trillion;

- Tesla Inc.: Up 905 percent, to $1.06 trillion.

- Meta Platforms Inc./Facebook: Up 105 percent, to $954 billion;

In October, Tesla CEO Elon Musk said he is moving his company to Texas. A cautionary tale, perhaps. But Hamish McKenzie wrote in his biography of Musk, “Since it acquired SolarCity in 2016 and added solar panels to its offerings, Musk has made his intentions clear: Tesla is an energy company. This is the story of how the electric car became a Trojan horse for a new energy economy. I believe it is the most important technology story of the twenty-first century.”

Read More From The PatriotAmerican

If Tesla is an energy company, then Texas is “the place you oughta be,” to quote the “Beverly Hillbillies” theme song—not California.

Yet Silicon Valley isn’t going anywhere. Despite high taxes and regulations, the Apple, Facebook and Google billionaires are not going to decamp for the hurricanes, humidity and insects of Florida or Texas.

There remain two problems. Most of us are not billionaires, or even millionaires. And the business cycle has not been repealed. One day, and no one can predict when, there will be another dot-com bust. And it could be much bigger than the one 20 years ago. Then what?