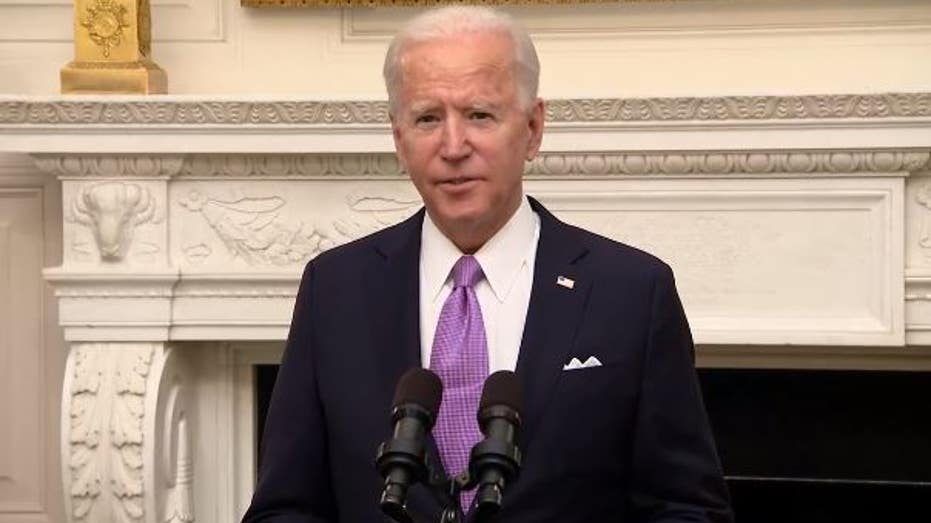

The inflation crisis in the U.S. will only worsen if President Biden cancels large swaths of student debt, experts warn.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget (CRFB), warned that student “debt cancellation may be an extremely appealing political talking point, but it is not good policy.”

“It is costly, inflationary, poorly targeted, and fails to address the root problems in our higher education financing system,” MacGuineas said in a statement Thursday. “Full debt cancellation would be a massive hand-out to rich doctors and lawyers, would worsen our inflation crisis, and would cost almost as much as the entire 2017 tax cuts.”

“Even partial debt cancellation would be costly, regressive, and inflationary,” she continued. “Forgiving $10,000 per person of debt would cost as much as universal pre-K or a full extension of the expanded ACA subsidies.”

“Either the President is serious about reducing deficits and getting inflation under control, or he is not. The White House can’t have it both ways,” MacGuineas added. “We need to be focusing on a serious and effective agenda that prioritizes sound policies, not poorly targeted political giveaways.”

Noah Weinrich, a spokesperson for Heritage Action, the campaign-side sister organization to conservative think tank the Heritage Foundation, told Fox News Digital that canceling student debt “would raise inflation by up to 20%.”

“Make no mistake: this is a handout to wealthy, educated voters that will come at the expense of higher prices for food, gas, and energy for working American families who won’t see a dime of relief — not to mention higher taxes,” he continued. “This is an absurd election-year gimmick that punishes most Americans.”

Manhattan Institute senior fellow Brian Riedl was less emphatic about the inflationary impact of canceling debt, though he made clear that he still views it as bad economic policy.

“If the president tries to permanently cancel a large portion of student debt, that may add perhaps 0.3% to this year’s inflation rate. Again, not helpful, but not a major driver of inflation,” Riedl told Fox News Digital.

“The problems with student loan forgiveness are that the policy would transfer these liabilities over to the taxpayers (raising deficits and ultimately taxes), disproportionately benefit upper-income attorneys and doctors, and also send a signal to current and future college students that they should borrow even more on the expectation of future loan forgiveness programs,” he added.

CRFB warned in February, when inflation was sitting at 7.48% and counting, that “canceling all $1.6 trillion of student debt would increase the inflation rate” by between 0.1% and 0.5% a year after the repayments are set to begin.

The organization put the cost of the federal government canceling all student debt at $1.6 trillion — nearly as much money as Biden’s signature $1.9 trillion American Rescue Plan — “while improving household balance sheets by a similar amount” and expecting “an $80 billion reduction in repayments in the first year.”

“The inflation effect of canceling $1.6 trillion in student debt would be small relative to the enormous amount involved, since repayments are spread out over time and the benefits of debt cancellation accrue mainly to higher earners, who tend to save more of their money,” CRFB’s analysis said.

“However, the increase is significant relative to the underlying inflation rate. It would represent a 4 to 20% increase relative to the Fed’s latest inflation forecast and a 5 to 25% increase above its target.”

The organization wrote that “even a modest increase in inflationary pressures could feed into current inflation dynamics, increasing the risk of a wage-price spiral and making it harder for the Federal Reserve to re-anchor inflation expectations around its current target.”

They also estimated that much of “this increase would also occur if the Biden administration continued the student loan payment moratorium for another year, since it would result in the same increase in cash flow to individuals.”

“Besides adding $1.6 trillion to the national debt and disproportionately benefiting higher-income individuals, we find student debt cancellation would cause prices to increase faster than they already are, exacerbating inflationary pressures,” CRBF warned.

On the other side of the cancelation conversation, CRBF predicted an increase in “household consumption by $70 to $95 billion once the effect of higher wealth is considered” if student debt is canceled but pointed out that the current U.S. economy simply cannot meet market demand in spite of “elevated disposable income, strong balance sheets, lingering supply constraints, and other factors.”

“This disconnect helps to explain why the inflation rate hit a 40-year high in the past year, and why further increasing demand could result in higher prices rather than higher output,” CRFB’s analysis said.

Additionally, CRBF said their estimations didn’t take into account the widespread effect that would hit tuition prices should student debt be forgiven.

“Prospective students may expect future rounds of debt cancellation, which could increase their willingness to take on more debt, thus decreasing their sensitivity to the prices that schools charge and ultimately making it easier for schools to increase prices even faster than they already do,” the organization writes.

White House press secretary Jen Psaki was asked by Fox News’ Jacqui Heinrich about the concerns of inflation rising due to the potential debt cancellation, responding that “the president is looking at the impact of student loans” and that “to make sure that these working families are getting relief is more important than tax cuts to millionaires, billionaires and corporations.”

“And we can make choices about where we invest and where we think we can make the tax system more fair,” Psaki said. “But there isn’t even a bill that’s moving through Congress, nor have we put a proposal together. So I don’t. Those numbers aren’t based on any reality at this moment.”

The inflation warning of a widespread student loan cancellation comes as Americans are facing higher prices across the board and the value of the dollar gets stretched thinner.

Read More From The PatriotAmerican

Inflation has soared throughout Biden’s first term in office and economists have pointed to Biden’s signature multitrillion-dollar spending package as one of the drivers of inflation.

The Banks are not on the hook for the canceled debt. The school already got their money. The Feds said they would back the student debt if canceled. The problem is the Fed’s don’t have money and they can’t just make it go away as it’s already spent. So it’s added to the National debt to be paid off by you guessed it. The taxpayers! You and me….

“Cancel student debt” is a lie. It is simple redistribution of money owed by some to those that were not a party to the contract. It is a tax and for what it’s worth the Executive Office has no authority to institute a tax. That must start in congress.