The Biden White House has said it wants to keep Trump tax cuts for the middle class after they expire, but the latest budget doesn’t offer a plan on what specific tax hikes will be pursued to pay for that massive cost to the Treasury.

And the amount needed to offset the tax cuts is huge, in the trillions of dollars.

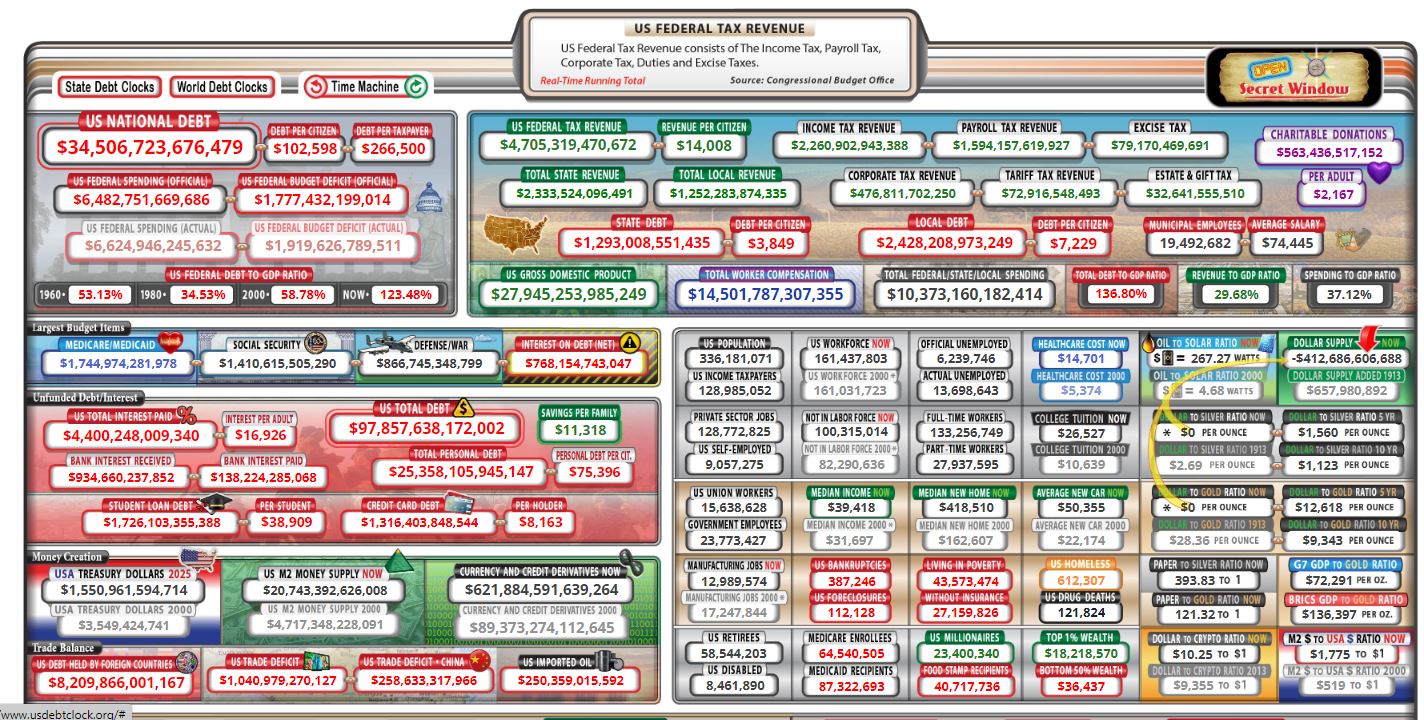

The Biden budget, revealed on Monday, features $7.3 trillion in spending and $5.5 trillion in tax revenue for fiscal 2025, bringing the deficit for the year to nearly $1.8 trillion. It also includes plans for new spending programs and new taxes on corporations and wealthy individuals over the next decade.

But it is also notable for what it leaves out. Namely, it is missing budget projections showing how the administration’s plan to renew a huge chunk of the Trump tax cuts would affect the country’s fiscal footing and how the White House plans to pay for it.

The backstory is that the Tax Cuts and Jobs Act, also known as the Trump or Republican tax cuts, was passed in 2017 and overhauled the tax code for corporations and people.

For procedural reasons, Republicans made it so that the individual provisions in the legislation were temporary, set to expire in 2025.

If the individual provisions under TCJA expire, most middle-class people would see a net tax hike, something that is politically unpalatable to both Republicans and Democrats.

Republicans are campaigning on winning the 2024 elections and re-upping their signature tax law.

The White House, on the other hand, is in a trickier position.

Biden campaigned on and has repeatedly vowed not to raise taxes on any people earning less than $400,000 annually. While the president is seeking to raise taxes on corporations and the wealthy, the White House has said it would push to keep the tax cuts for the middle class. It is also aiming to further enlarge the child tax credit, which the GOP tax law expanded.

“President Biden supports continuing tax cuts for families making less than $400,000, but opposes extending tax cuts or restoring tax breaks for those making more than $400,000 per year,” the White House said last week.

The problem is that the provisions that affect those earning less than $400,000 per year are the biggest part of the 2017 tax cuts and make up about 75% of the bill’s total cost, according to Brian Riedl, a budget expert at the Right-leaning Manhattan Institute.

Despite that, the White House budget released this week doesn’t account for keeping those parts of the TCJA — which, again, are already set by Republicans to expire — in place. The increased cost would have been huge. If it were included, the White House would need either to significantly increase its projections for future budget deficits or add significant tax increases.

“The White House claims their budget will cut the deficit by $3 trillion over the decade, but that’s because they left out the $2.4 trillion cost of the president’s proposal to extend the tax cuts for all families earning under $400,000,” Riedl told the Washington Examiner during an interview, referencing the $2.4 trillion as a number representing 75% of the total cost of extending the TCJA. (He noted that because there is no scoring for that group, these are only estimates.)

A White House spokesperson said Biden “supports paying for extending tax cuts for people earning less than $400,000 with additional reforms to ensure that wealthy people and big corporations pay their fair share, so that the problematic sunsets created by President Trump and congressional Republicans are addressed in a fiscally responsible manner.”

The Biden budget already includes several other major tax hikes, such as raising the corporate tax rate from 21% to 28% and a 25% minimum tax for billionaires. But those tax hikes are already being used to pay for other new proposals in the budget, not extending the 2017 tax cuts.

Garrett Watson, a senior policy analyst at the Tax Foundation, told the Washington Examiner that he interprets the lack of any projections in the Biden budget that include extensions to TCJA to mean the White House “has additional tax hikes in mind beyond the $5 trillion in explicit tax hikes to pay for it.”

“To offset this, they’d need $1.5 to $2 trillion in additional tax hikes, which would amount to a historic set of tax increases,” Watson explained. “For perspective, that would be about double the amount of tax hikes Biden proposed in his 2020 campaign.”

But this isn’t the only issue some budget hawks see with the Biden budget. Riedl said another budget “gimmick” relates to the child tax credit.

The budget includes restoring the child tax credit to the supercharged level it was temporarily at as part of the pandemic-era American Rescue Plan Act, which passed with no Republican support.

The current tax credit is $2,000 a child. The 2021 Democratic legislation raised it to $3,600 for children under 6 and $3,000 for older children, with perhaps the biggest change being the removal of an income threshold for those who receive the funds. Thus, a family with no income or head of household working would also receive the full $3,600 or $3,000 payments. The boosted tax credit sunset at the end of 2021.

Read More From PatriotAmerican

The Biden budget proposed restoring the boosted benefit but only for 2025, meaning its effects on the deficit are only being modeled on a temporary one-year basis rather than what it would look like if it were expanded for the whole 10-year budget window.

“It only includes the first year of a policy that he surely wants to make permanent. That’s about $800 billion in costs that the president is not counting,” Riedl said.