by Zachary Halaschak, Economics Reporter

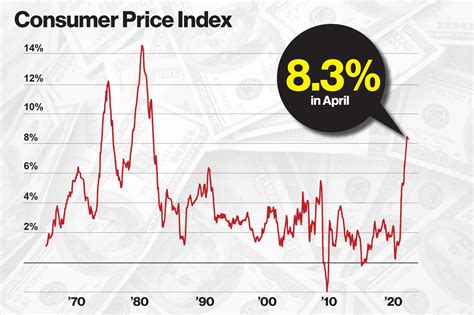

Inflation slowed slightly to 8.3% for the 12 months ending in April, according to the consumer price index, the first decline in eight months but still a higher rate than economists had predicted.

The much-anticipated numbers reported by the Bureau of Labor Statistics on Tuesday revealed that inflation is still going strong despite the Federal Reserve’s interest rate hikes and is near the worst it has been since February 1982 during the Great Inflation that helped bring President Ronald Reagan to office.

The soaring inflation has eaten into President Joe Biden’s approval ratings as he and Democrats approach the midterm elections. Consumer prices have been rising fast since last August, especially for staples such as food and gas. Typical weekly grocery bills, for example, have risen by more than $30.

Energy prices moderated in April but have soared 30.3% over the past year, while food prices have surged 9.4%, according to the data released on Wednesday.

Although headline inflation fell, the details of Wednesday’s report hinted at underlying upward pressure on prices. Core CPI, which measures the changes in the price of goods and services excluding food and energy, rose by a strong 0.6% for the month, more than the 0.4% that economists had predicted.

“With the annual rate ticking down from 8.5% to 8.3, it can be tempting to say we’ve seen the peak, but we’ve also been head-faked before as was the case last August,” said Greg McBride, chief financial analyst at Bankrate. “Core prices that had been a reason for hope one month ago are a reason for disappointment this month.”

The indices for shelter, airline fares, new vehicles, medical care, and recreation all ticked up in April, while the indices for apparel, communication, and used cars and trucks all trended downward last month.

In some good news for the economy, used-car prices, which were previously a big driver of inflation, fell for the third month in a row.

The Federal Reserve announced in March that it would raise its interest rate target by a quarter of a percentage point, the first rate hike since 2018, in an effort to rein in the higher prices, although some economists and many Republicans say the central bank should have moved sooner to reverse its pandemic emergency measures.

This month, the Federal Open Market Committee announced it would increase its interest rate target by a half percentage point. The central bank typically raises rates by just a quarter percentage point, so the move is equivalent to two rate hikes at once and shows that the Fed is concerned with the growing prices.

The central bank also signaled that it may end up conducting more half-point hikes at its next meetings in June and July, meaning that all indications are that interest rates will continue to rise over the next year.

Further adding to the inflationary flames is the war in Ukraine. The conflict has pushed energy prices through the roof because Russia is one of the world’s largest producers of oil and natural gas.

The average price of gas in the United States rose to a record high on Tuesday of $4.37 a gallon, according to AAA.

Read More From The PatriotAmerican

There are also concerns that the Fed’s aggressive action to hike interest rates could plunge the economy into a recession, a prospect that also doesn’t bode well for Biden and Democrats who have been running on the strong labor market and ultralow unemployment.